Exness Limited Reviews: A Comprehensive Look

In the world of online trading, the choice of broker can significantly influence your success. This is especially true when it comes to well-established firms like Exness Limited. In this article, we will explore Exness Limited reviews to provide potential traders with a detailed understanding of what the broker offers, key features, advantages, and disadvantages. For our South African audience, you might find additional insights by visiting exness limited reviews Exness South Africa.

Overview of Exness Limited

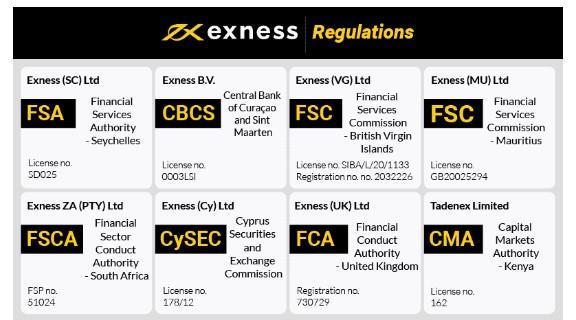

Founded in 2008, Exness has rapidly become one of the leading forex and CFD brokers worldwide. With its commitment to transparency and customer service, it has attracted millions of traders, both novice and experienced. Exness operates under the principles of a market-maker that facilitates trading on various asset classes while providing a robust trading platform. With headquarters in Cyprus, the broker is regulated by top-tier authorities such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

Trading Platforms

Exness provides access to several trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are popular among traders due to their user-friendly interfaces and advanced charting capabilities. The platforms support automated trading and offer a range of trading tools, making it easier for traders to analyze market trends.

Asset Variety

One of the standout features of Exness is the variety of assets available for trading. Traders can access a wide range of financial instruments, including:

- Forex pairs

- CFDs on stocks

- Commodities

- Cryptocurrencies

- Indices

This wide selection allows traders to diversify their portfolios and explore different markets, increasing their chances of profitability.

Account Types

Exness offers several account types tailored to different trading styles and experience levels. Here’s a quick overview:

- Standard Account: Ideal for beginners, offering a user-friendly experience with flexible trading conditions.

- Pro Account: Designed for more experienced traders, providing tighter spreads and additional features.

- ECN Account: Suited for high-frequency traders, offering direct market access and raw spreads.

Each account type has its own advantages and can cater to various trading strategies effectively.

Fees and Spreads

When analyzing broker reviews, fees and spreads are crucial factors. Exness boasts competitive spreads, starting from 0.0 pips in their ECN accounts. The broker does not charge any commission on standard accounts, while the commissions on the Pro and ECN accounts are quite reasonable. Additionally, Exness does not have any hidden fees, making it a transparent choice for traders.

Deposit and Withdrawal Options

Exness supports a wide range of deposit and withdrawal methods, including bank transfers, credit/debit cards, and various e-wallets. This convenience ensures traders can easily manage their funds. Furthermore, Exness is known for its fast processing times, typically allowing deposits and withdrawals to be completed within hours. However, the exact times can vary depending on the payment method chosen.

Customer Support

Effective customer support is essential for a good trading experience. Exness offers 24/7 customer support in multiple languages, including live chat, email, and telephone assistance. Many traders have reported positive experiences with Exness’s support team, citing quick response times and helpful resolutions to inquiries.

Education and Resources

For novice traders, Exness provides a range of educational resources, including webinars, articles, and video tutorials. These resources can significantly enhance a trader’s knowledge and skills, especially if they are new to forex trading. Additionally, the broker offers a demo account where traders can practice trading strategies without risking real money.

Security and Regulation

As a regulated broker, Exness takes the security of its clients’ funds very seriously. The company holds client funds in segregated accounts, ensuring they are protected even in the unlikely event of bankruptcy. Moreover, Exness uses advanced security measures, such as two-factor authentication (2FA), to protect user accounts from unauthorized access.

Pros and Cons of Exness

Every broker has its strengths and weaknesses. Here are the main pros and cons of trading with Exness:

Pros:

- Wide range of trading instruments

- Competitive spreads and low minimum deposits

- Robust educational resources for traders

- Excellent customer support

- Strong regulatory compliance

Cons:

- Limited selection of educational content for advanced traders

- Withdrawal processing times may vary based on the chosen method

Conclusion

Exness Limited has established itself as a reliable option for traders looking for a robust trading experience. With its competitive trading conditions, diverse account types, and solid customer support, it is a suitable choice for both novice and experienced traders. Reading comprehensive Exness Limited reviews can help potential clients make informed decisions regarding their trading endeavors. Overall, Exness continues to be a competitive player in the online trading industry.

As you consider your options, remember that thorough research is key to successful trading. If you’re ready to get started, Exness provides an excellent platform to launch your trading journey.